Managing money as a student can be challenging, especially when balancing tuition fees, living costs, and social life. The 52-week savings challenge for students in 2025 offers a straightforward, stress-free way to build over $1,378 in a year with minimal effort. By starting small and gradually increasing the amount you save each week, this challenge creates consistent habits that can transform your financial future.

What Is the 52-Week Savings Challenge for Students?

The 52-Week Savings Challenge for Students is a step-by-step method where you save a set amount each week, starting with $1 in Week 1 and increasing by $1 each following week. By Week 52, you’ll be setting aside $52, and the total savings at the end of the year will be exactly $1,378.

How it works:

- Week 1: Save $1

- Week 2: Save $2

- Week 3: Save $3

- … and so on until Week 52.

This gradual build-up makes it perfect for students, as it eases you into the habit without overwhelming your budget.

Why the 52-Week Savings Challenge Works for Students

Students often struggle to set aside large amounts of money at once. This challenge:

- Builds consistency without high pressure.

- Adapts to student budgets — you can start with small amounts.

- Motivates you visually — tracking progress helps maintain momentum.

- Provides flexibility — you can reverse it (start with $52) during high-earning months like summer jobs.

Flexible Versions for Student Lifestyles

Not all students have the same income patterns. Here are two variations:

- Standard Method – Start with $1 in Week 1 and build up to $52 in Week 52.

- Reverse Method – Start with $52 and decrease each week. Perfect if you expect more expenses later in the year.

- Custom Weekly Goal – Set a flat amount each week (e.g., $25/week) to suit your budget.

Step-by-Step Guide to Starting the Challenge

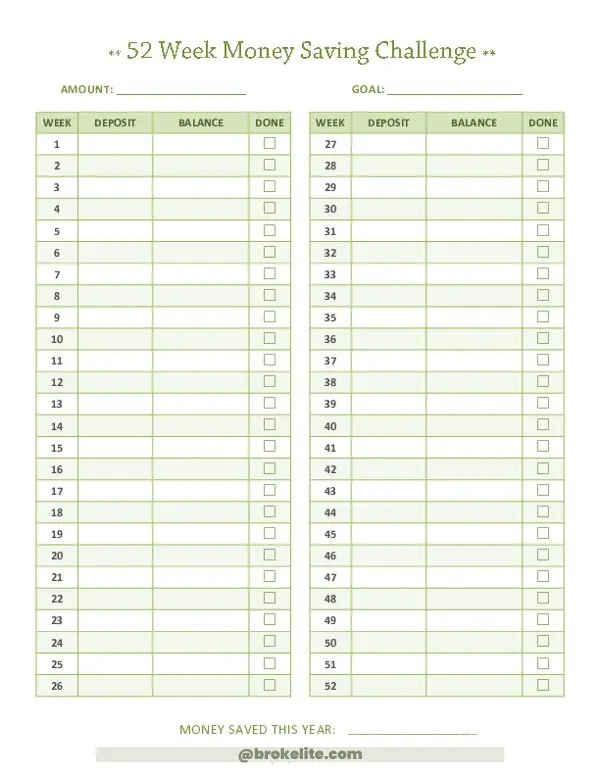

Step 1: Get Your Tracker

Download or create a printable savings tracker. Pin it somewhere visible — like your dorm room wall — to remind yourself weekly.

Step 2: Decide Your Order

Choose standard, reverse, or custom depending on your expected income flow.

Step 3: Automate Your Savings

Set up automatic transfers from your checking to a savings account every week.

Step 4: Stay Consistent

If you miss a week, double up the next or adjust the following weeks.

Step 5: Celebrate Milestones

Reward yourself after every $100 saved to keep motivation high.

Pro Tips to Boost Savings During the Challenge

- Use Round-Up Apps – Apps like Acorns or banking round-up features can automatically add extra change to your savings.

- Combine with Side Hustles – Put income from tutoring, freelance work, or campus jobs directly into your savings.

- Keep It in a Separate Account – Avoid dipping into your savings by keeping it away from your daily spending account.

- Earn Interest – Even a small interest-bearing account adds extra cash by the end of the year.

- Peer Accountability – Form a savings group with friends to encourage each other.

How to Adapt the 52-Week Savings Challenge for Students in College Life

- Align with Semester Breaks – Save more during summer or winter jobs.

- Cut Unnecessary Subscriptions – Redirect that money into your weekly savings.

- Sell Unused Items – Textbooks, clothes, and gadgets can generate quick savings boosts.

- Pair It with Budgeting – Use free apps like Mint to track expenses alongside your challenge progress

Example Savings Tracker for 2025

| Week | Amount to Save | Total Saved |

|---|---|---|

| 1 | $1 | $1 |

| 2 | $2 | $3 |

| 3 | $3 | $6 |

| … | … | … |

| 52 | $52 | $1,378 |

You can download a printable version and tick off each week as you complete it.

Frequently Asked Questions

Can I start mid-year?

Yes! Simply start with the corresponding week or choose the reverse order to match your budget cycles.

What if I miss a week?

Make up for it the following week or spread the missed amount across future weeks.

Is the reverse version better?

It depends. If you have more disposable income early in the year (e.g., from a seasonal job), start high and work down.

Do I need a special bank account?

No, but a separate savings account helps prevent spending the saved money accidentally.

Final Thoughts

The 52-week savings challenge for students in 2025 is more than a budgeting trick — it’s a habit-forming system that turns small amounts into big results. By following the plan, you can end the year with $1,378 ready for emergencies, textbooks, or personal goals. Whether you stick to the traditional method, reverse version, or your own twist, the key is consistency.

Start today, track your progress, and enjoy watching your savings grow — one week at a time.

💡 Pro Internal Link:

If you’re looking for more ways to maximize your earnings while studying, check out our post on Loud Budgeting for Gen Z Students — it pairs perfectly with these side hustle ideas to help you manage your money smarter.

1 comment

[…] you’re looking for even more ways to save money during your studies, check out our 52-Week Savings Challenge for Students — it’s a perfect companion to your meal prep […]